Archive

The Collapse of FTX

By Craig Murray 15th November 2022. Find Article Here:-

This is what I think of as a signpost article – it points you to something the mainstream media is deliberately not giving the prominence it needs, but I have no personal expertise or inside knowledge to give you. I am just giving you a start to get going. Several readers will have a much better understanding than I, and I encourage you to give your thoughts in comments below.

It is also worth noting that only the immediate improvement to freedom of speech on Twitter by Elon Musk has brought this to my attention. Several sources – particularly Citizens for Legitimate Government – have suddenly appeared in my feed again after being entirely suppressed.

My own tweets are, for now, less suppressed – my own family have been receiving notifications from me after they were stopped for over a year. I am not in general a fan of billionaires like Musk, and I do not know where Twitter will settle, but there is undoubted initial improvement.

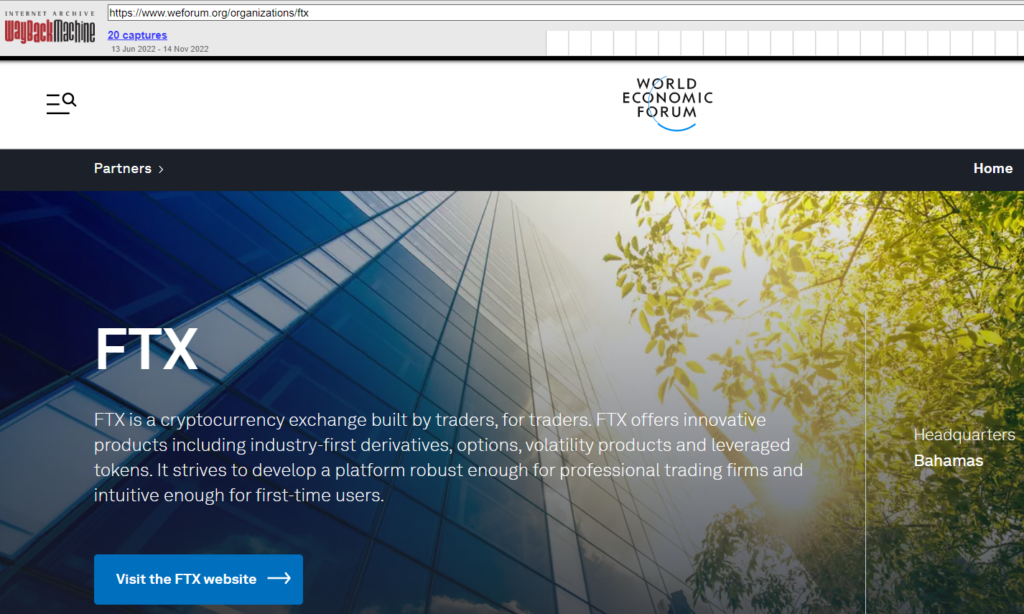

The FTX story seems truly remarkable. From being founded only in 2017 it rose to be a “partner organisation” of the World Economic Forum and the second largest donor to Biden and the Democrat’s mid-term election campaign. It has now gone completely bust, taking every penny of its depositors money with it.

That is some trajectory.

The World Economic Forum has deleted its FTX page, but the Wayback machine has it:

I suppose it is inevitable that dodgy chancers would create derivatives markets for gambling on crypto, but I confess I had not given the matter much thought. It goes without saying that in those five years the founder of FTX had managed to take a huge personal fortune out of the company before it went bust.

FTX was a one man company belonging to Sam Bankman-Fried. The board consisted of him, an employee and the company lawyer. Over US$20 billion of investors’ funds from FTX were funneled to a fund management company, Alameda Research, also owned by Sam Bankman-Fried.

$37 million was donated by Bankman-Fried to the Democrats for the 2022 elections. Every penny of that originated with duped FTX investors. That is in addition to the $5 million given to the Biden 2020 campaign. FTX, of course, crashed instantly after those mid-term elections, which is interesting timing.

The BBC and the Guardian were constantly bombarding us with the term “democracy denier” in their coverage of the US elections, strangely not in reference to Hillary’s ludicrous claims that Russian interference was the cause of her loss in 2016.

I view as a joke any notion that the USA is a democracy. Democracy is about giving citizens a choice of political direction. The 2022 elections saw a simply incredible campaign spend of US$ 9.7 billion. Yes, nearly ten billion dollars. This is not democracy, it is a huge exercise in corporate control from which the ordinary citizen is frozen out.

Despite an aggressive tribalism which has stalemated the political system for decades, the difference in policy platform between Democrats and Republicans is highly marginal, with no alternative on offer to rampant and uninhibited commercial exploitation of the population by the super-wealthy.

The Democrats are marginally more keen on attacking other countries; the Republicans are marginally more against measures to curb carbon emissions. Vaunted differences on immigration and welfare turn out to be very small indeed, with very little changing when the White House does.

American elections are simply about the super rich funneling in vast donations, expecting to benefit when their team gets its nose in the trough, or often donating to both sides to benefit either way.

I am not sure what the connection to democracy is supposed to be.

One simple fact illustrates the true nature of the bribery fest. By far the majority of the funds channeled through Political Action Committees (PACs) are given to incumbents who face no serious threat to re-election anyway. The PAC’s are interested in bribing those in power, not changing those in power. They are simply lobby groups with an opportunity for legal bribery. To illustrate that, the largest donating PACs are:

National Assn of Realtors

National Beer Wholesalers Assn

American Israel Public Affairs Cmte

Credit Union National Assn

Blue Cross/Blue Shield

American Crystal Sugar

It is worth noting that Bankman-Fried donated ten times as much as the largest PAC donation. This brought access – he and his brother had meetings inside the White House on 7 March, 22 April and 12 May.

It is perhaps unsurprising therefore that FTX was involved in Ukraine, offering to exchange cryptocurrency for fiat and send it to Ukraine in an official partnership with the Ukrainian government. This from their press release

Aid For Ukraine is cooperating with the cryptocurrency exchange FTX which converts crypto funds received into fiat and sends the donations to the National Bank of Ukraine. This marks the first-ever instance of a cryptocurrency exchange directly cooperating with a public financial entity to provide a conduit for crypto donations. Earlier this month, FTX already converted $1 million worth of SOL and transferred it to the National Bank of Ukraine.

The collapse of the Bankman Fried scam was allegedly caused by hackers stealing what should have been a comparatively small portion of the assets of FTX, had they not been hived off elsewhere. Doubtless we will shortly hear from state salaried conspiracy theorists that this was Russia/Guccifer/an ISP address traced by Bellingcat to inside the Kremlin.

What we really have here is an Allen Stanford for 2022, with added political connections.

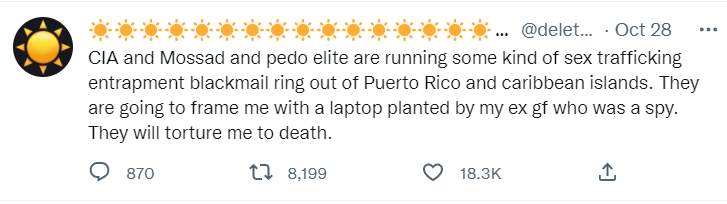

We would do well to heed the advice of crypto developer Nikolai Mushegian, who had as his Twitter profile: “Larpers who self-style as CEOs or CTOs or VCs are a bigger problem than the establishment. They can’t build anything and will sell you out in 2 seconds.”

His final tweet was posted on 28 October:

The next day he drowned in the sea off a beach in Puerto Rico, where he lived. He was fully clothed including a jacket. The police are not treating it as homicide so presumably their theory is suicide by wading out to sea.

States of course have a massive incentive to destroy non fiat currencies, or convert them into a new category of regulation. I am interested in the current discussion on smart state digital currencies where the state can track, control and block any transaction and know in real time exactly where each citizen or entity is spending or keeping every penny.

It occurs to me this is the wrong way round. The state belongs to its citizens, not the citizens to the state. We should be able to track online every single penny of public money in real time and see how it is spent. Imagine being able to follow every penny of the billions the Tories spent on fraudulent PPE contracts, for example.

The only people whose personal currency should be able to be tracked are those who hold, or have held, positions of power in the state. Their wealth and dealings should be available in great detail to public view. As for the rest of us, our money is ours and we are entitled to privacy.

Neil Oliver – ‘…digital enslavement is coming…’

Posted 7th October 2022. Find 19min Video Here:-

Johnny’s Cash and the Smart Money Nightmare.

Posted 4th October 2022. Find 15min Video Here:-

Please download and re-post this video. You can download it by right clicking the download link and select save as http://cdn1.richplanet.net/mp4/300_01… It is vital that every person understands what the proposed changes to the monetary system will mean. The changes, if allowed to happen, could be the most devastating event in our lifetime and potentially the biggest removal of liberty in modern history.

Neil Oliver: ‘By taking back control of the money we can begin regaining control of our world’.

Posted 1st October 2022. Find 9min 20sec Video Here:-

Want to see how much Truss and Kwarteng’s disastrous ‘mini-budget’ is going to cost us?

Neil Oliver: ‘Don’t be fooled into thinking this disaster movie is coming to an end’.

Posted August 27th 2022. Find 11min 25sec Video Here:-

Neil Oliver reacts to Rishi Sunak saying experts had too much power over Covid lockdowns.

Neil Oliver: ‘It’s hard to tell yourself you’ve been taken for a fool but open your eyes’.

Posted 13th August 2022. Find 10min Video Here:-

Neil, says it like it is, again. Nail on the head, on the money.

People need to wake up and see how they are being shafted by their ‘Lords and Masters’.

This Crisis has been some time in the making but the outcome was something inevitable.

No Government in my lifetime has had any really clear thinking regarding plans for the longterm future. Mostly their plans have involved short term monetary gains or using our countries wealth and resources to plug a gap or solve a financial crisis. Selling off the family silver, Public Private Partnership and Privatising the NHS. Then there is Tax Payers money used to build Aircraft carriers with no Aircraft… Or simply giving Billions to a country at War.

Don’t get me started on the wastage…

BlackRock CEO and WEF globalist Larry Fink says corporations must work harder to ‘force’ people to change behaviours.

By Leo Hohmann. 24th March 2022. Find Article Here:-

Our last two articles have attempted to peel back the layers of the World Economic Forum (WEF) and its drive to usher in an all-new type of global society based on total information domination.

If they are successful, everything you do in life will be reduced to digital bits of storable data. That includes where and how you spend your money, where and how you travel or move about in society, your health and education records. In the name of privacy and security, you will hand all of this information over to them, you will own none of it and yet you will be happy, they said.

We’ve looked at the man Noah Yuval Harari, the chief philosophical adviser to the WEF, which has been working toward the attainment of a global surveillance society for 40 years under the direction of its founder Klaus Schwab. They hope to bring it about through “partnerships” between governments and corporations.

Now let’s take a look at another WEF power player who operates in the shadows, who boldly seeks to fundamentally transform the world through the “Great Reset.”

He is the chairman and CEO of BlackRock, the world’s largest investment firm with $10 trillion in assets, a firm that has at least a partial ownership of almost every major corporation in the world, including the big media and Big Tech companies.

So Fink is not your average CEO. He:

- Plays a key role at Klaus Schwab’s World Economic Forum, where he is a member of the board of trustees and listed as one of the top “agenda contributors.”

- Sits on the board of directors for the Council on Foreign Relations (CFR), which has been the most powerful driver of U.S. foreign policy for the last 75 years, to the point where it’s impossible to work in the upper echelons of the U.S. State Department without being a member of this elitist globalist club.

- Sits on the board of the International Rescue Committee, one of nine private agencies that works to funnel refugees into North America and Europe, mostly from countries that CFR-trained diplomats and Pentagon apparatchiks help to destabilize with wars and revolutions. These refugees come from places like Afghanistan, Syria, Iraq, Yemen, Somalia and Sudan, cultures that don’t typically mix well in Western societies.

So when Fink speaks, the world’s most powerful business leaders are all ears. He controls trillions of dollars in investment money and sits on all the key globalists boards.

Here’s what he had to say in a New York Times forum from four years ago:

“Behaviors are going to have to change and this is one thing we are asking companies, you have to force behaviors and at BlackRock, we are forcing behaviors,” Fink said.

Was this a Freudian slip of the tongue? I’m guessing it was, because Fink is usually not this brutally honest in communicating his beliefs.

Following is a quote from Fink’s 2022 letter to CEOs worldwide:

“Every company and every industry will be transformed by the transition to a net-zero world. The question is, will you lead, or will you be led?”

That sounds like a threat.

After receiving some serious blowback, Fink tried to walk back his comments. On Jan. 24, 2022, Fink told CNBC “I’m not trying to strong arm CEOs to adopt my worldview,” even though everyone knows he is. That’s what Fink is all about. He’s the leader of the global movement to create a social-scoring system for corporations related to how environmentally and socially “woke” they are. This is called the ESG scoring system. ESG stands for “environmental, social and governance” score.

If you don’t believe in the fake science that says humans are the primary cause of global environmental degradation and you don’t believe that gender is fluid, you will not qualify for investment going forward in Fink’s world.

According to Riley O’Donnell at Measurabl.com, Fink’s letter “carries a warning call to every sector – all of which will inevitably be changed by sustainable technology. Fink highlights the idea that those who decarbonize will be those who lead. Leveraging the power of actionable ESG data is crucial in this global transition towards a net-zero world.”

Fink is warning the world’s top CEOs: It’s no longer enough to just be a good capitalist, doing what’s right for your shareholders and employees. You must work to “better society or risk losing support from BlackRock.”

And how do you “better society” in Fink’s way of thinking? You become a global citizen first, only secondarily considering yourself an American, Canadian, French, German or Ukrainian citizen, and then you adopt a “woke” view of the world.

Here is another excerpt from his 2022 letter to CEOs:

“Capitalism has the power to shape society and act as a powerful catalyst for change.

But businesses can’t do this alone, and they cannot be the climate police. That will not be a good outcome for society. We need governments to provide clear pathways and a consistent taxonomy for sustainability policy, regulation, and disclosure across markets. They must also support communities affected by the transition, help catalyze capital for the emerging markets, and invest in the innovation and technology that will be essential to decarbonizing the global economy.

“It was the partnership between government and the private sector that led to the development of COVID-19 vaccines in record time.

When we harness the power of both the public and private sectors, we can achieve truly incredible things. This is what we must do to get to net zero.“

Fink refers to this new system as “capitalism” but don’t be fooled. This is capitalism in the same way China practices capitalism, with everything the private sector does being done in “partnership” with the central government planners.

This is why the Biden administration continuously beats the drum of companies “doing the right thing” and forcing their employees to get the experimental gene-therapy injections — and that includes your kids, too.

As a good global citizen under the BlackRock-WEF definition of “capitalism” you will obey the state and your corporate master by keeping up to date on your shots (all of them including the latest “booster” from Big Pharma), you adopt their radical climate agenda, which means you either drive an expensive electric car, ride public transportation or a bicycle to work and back, you forego eating meat, you live in a tiny house or high-rise apartment, and you believe as a matter of faith all the radical social justice ideas like critical race theory, transgenderism, etc. Oh, and you will turn in your firearms in your city’s latest “buy back” program.

These are the kind of “behaviors” that Fink wants your corporate employer to “force” you to adopt.

Fink popped off this week saying the war in Ukraine will “accelerate the shift to ESGs and digital currencies as a replacement for cash.”

But most of these changes in the rules of society will only apply to the commoners, not the elitist professors, entertainers and corporate billionaires at the World Economic Forum.

Take for example, the friendly advice that was given us from Bloomberg News, which is owned by Michael Bloomberg, another billionaire member of the World Economic Forum and friend of Fink’s.

Bloomberg offered up some advice in the tweet below for us peasants (those making under $300,000 a year) struggling to make ends meet in Joe Biden’s inflationary economy.

Could you get more arrogant? The Bloomberg writer above left no question about the fact that he thinks if you make less than $300,000 a year, you aren’t worthy of being a consumer of meat. Get over yourself and settle for lentils?

And it’s time to park that car. Just take the bus.

Of course, the privileged ones above that $300,000 mark will continue on as normal, no sacrifices necessary.

They don’t tell you that moving to “net zero” carbon emissions, which is advocated by Fink, along with Bloomberg, Gates, Harari, Zuckerberg, Schwab and the rest of the globalist cult, would throw 90 percent of middle-class Americans into poverty and dependence, which is exactly what they want. They want a much smaller global population with those who are lucky enough to remain to be 100 percent dependent on the government and its corporate “partners” in a system they call “stakeholder capitalism.”

Stakeholder capitalism is just a fancy word for fascism, the type of system they have in China. Big business and big government in collusion to oppress the people, monitoring their every move and assessing them in real time as to whether they get points or demerits on their social credit score.

Whereas Harari is a man of ideas, Fink is a man of money and brute force.

So when he speaks, other corporate honchos listen.

And he’s telling them to force behavioral changes on their employees.

We know what those changes are. We know the things we as believers will need to resist in the coming months. I would like to say we have years, and maybe we will, but I can’t guarantee that.

It will not be easy to live outside the beast system but we can help mitigate the difficulties by working together. We can do this. Because inside the system there will be only more manipulation, surveillance and brutal control from beast-like men in the vein of Schwab, Harari, Gates, Zuckerberg, Bloomberg and Fink.

Share this article/video with your friends, along with the previous two articles that dig into Harari and they will get a clue what the world is up against and why everything always drifts toward tyranny. It happens because men like Schwab, Harari, Gates, Zuckerberg and Fink have too much power and sway over the politicians we elect.

Revealed: oil sector’s ‘staggering’ $3bn-a-day profits for last 50 years.

By Damian Carrington 21st July 2022. Find Article Here:-

Vast sums provide power to ‘buy every politician’ and delay action on climate crisis, says expert.

The oil and gas industry has delivered $2.8bn (£2.3bn) a day in pure profit for the last 50 years, a new analysis has revealed.

The vast total captured by petrostates and fossil fuel companies since 1970 is $52tn, providing the power to “buy every politician, every system” and delay action on the climate crisis, says Prof Aviel Verbruggen, the author of the analysis. The huge profits were inflated by cartels of countries artificially restricting supply.

The analysis, based on World Bank data, assesses the “rent” secured by global oil and gas sales, which is the economic term for the unearned profit produced after the total cost of production has been deducted.

The study has yet to be published in an academic journal but three experts at University College London, the London School of Economics and the thinktank Carbon Tracker confirmed the analysis as accurate, with one calling the total a “staggering number”. It appears to be the first long-term assessment of the sector’s total profits, with oil rents providing 86% of the total.

Emissions from the burning of fossil fuels have driven the climate crisis and contributed to worsening extreme weather, including the current heatwaves hitting the UK and many other Northern hemisphere countries. Oil companies have known for decades that carbon emissions were dangerously heating the planet.

“I was really surprised by such high numbers – they are enormous,” said Verbruggen, an energy and environmental economist at the University of Antwerp, Belgium, and a former lead author of an Intergovernmental Panel on Climate Change report.

“It’s a huge amount of money,” he said. “You can buy every politician, every system with all this money, and I think this happened. It protects [producers] from political interference that may limit their activities.”

The rents captured by exploiting the natural resources are unearned, Verbruggen said: “It’s real, pure profit. They captured 1% of all the wealth in the world without doing anything for it.” The average annual profit from 1970-2020 was $1tn but he said he expected this to be twice as high in 2022.

The profit-grabbing is holding back the world’s action on the climate emergency, he said: “It’s really stripping money from the alternatives. In every country, people have so much difficulty just to pay the gas and electricity bills and oil [petrol] bill, that we don’t have money left over to invest in renewables.”

Some of the rents go to governments as royalties, says Prof Paul Ekins, at University College London: “But the fact remains that, over the last 50 years, companies have made a huge amount of money by producing fossil fuels, the burning of which is the major cause of climate change. This is already causing untold misery round the world and is a major threat to future human civilisation.

“At the very least these companies should be investing a far greater share of their profits in moving to low-carbon energy than is currently the case. Until they do so their claims of being part of the low-carbon energy transition are among the most egregious examples of greenwashing.”

Mark Campanale, at Carbon Tracker, said: “Not only is the scale of these rents eye-watering, but it is salient to note that, in the midst of a cost of living crisis caused by record oil and gas prices, this flow of money to a relatively small number of petrostates and energy companies is set to double this year. Shifting to a carbon-neutral energy system based on renewables is the only way to end this madness.”

The Guardian revealed in May that the world’s biggest fossil fuel firms are planning scores of “carbon bomb” oil and gas projects that would drive the climate past internationally agreed temperature limits with catastrophic global impacts. The fossil fuel industry also benefits from subsidies of $16bn a day, according to the International Monetary Fund.

Verbruggen’s analysis used the World Bank’s oil rent and gas rent data, which the bank compiles country-by-country and is expressed as percentage of global GDP. He then multiplied this by the World Bank’s global GDP data and adjusted for inflation to put all the figures in 2020 US dollars.

Verbruggen said oil-rich nations, such as Russia and those in the OPEC cartel, including Saudi Arabia, kept rents high by restricting supply: “They change the fundamentals of the markets.” Military action, such as the US-led invasion of Iraq in 2003, and political action, such as the embargo on oil exports from Iran, had also increased the rents, he said. If all available oil and gas could be freely supplied to the market, the price of conventional oil would be $20-30 a barrel, Verbruggen said, compared with about $100 today.

There is far more oil, gas and coal in existing reserves than can be burned if the world is to limit global heating to 1.5C, the target agreed by nations in the Paris climate agreement in 2015. Campanale said: “To keep to 1.5C, this means [international oil companies alone] forgoing around $100 trillion of potential revenues. You can see why oil oligarchs and nations controlled by political elites want to keep their fossil fuel rents, the source of their power.”

May Boeve, the head of campaign group 350.org, said: “These profits have enabled the fossil fuel industry to combat all efforts to switch our energy systems. We have to dismantle such rent-seeking systems and build our future based on accessible and distributed renewable energy that is more sustainable and democratic in every way.”

THE FINANCIAL AGENDA BEHIND THE CURTAIN DAVE CULLEN TALKS WITH MELISSA CIUMMEI

Posted by Computing Forever 12th July 2022. Find 57min Video Here:-

Dave and Melissa discuss the effects of the last two years upon the population, Lockdown, Vaccines, Digital ID’s and the coming Financial Collapse.